What are your responsibilities as an apartment guarantor? Here are 4 sample agreements

You don't have much leverage to negotiate the terms of the agreement with the landlord.

iStock

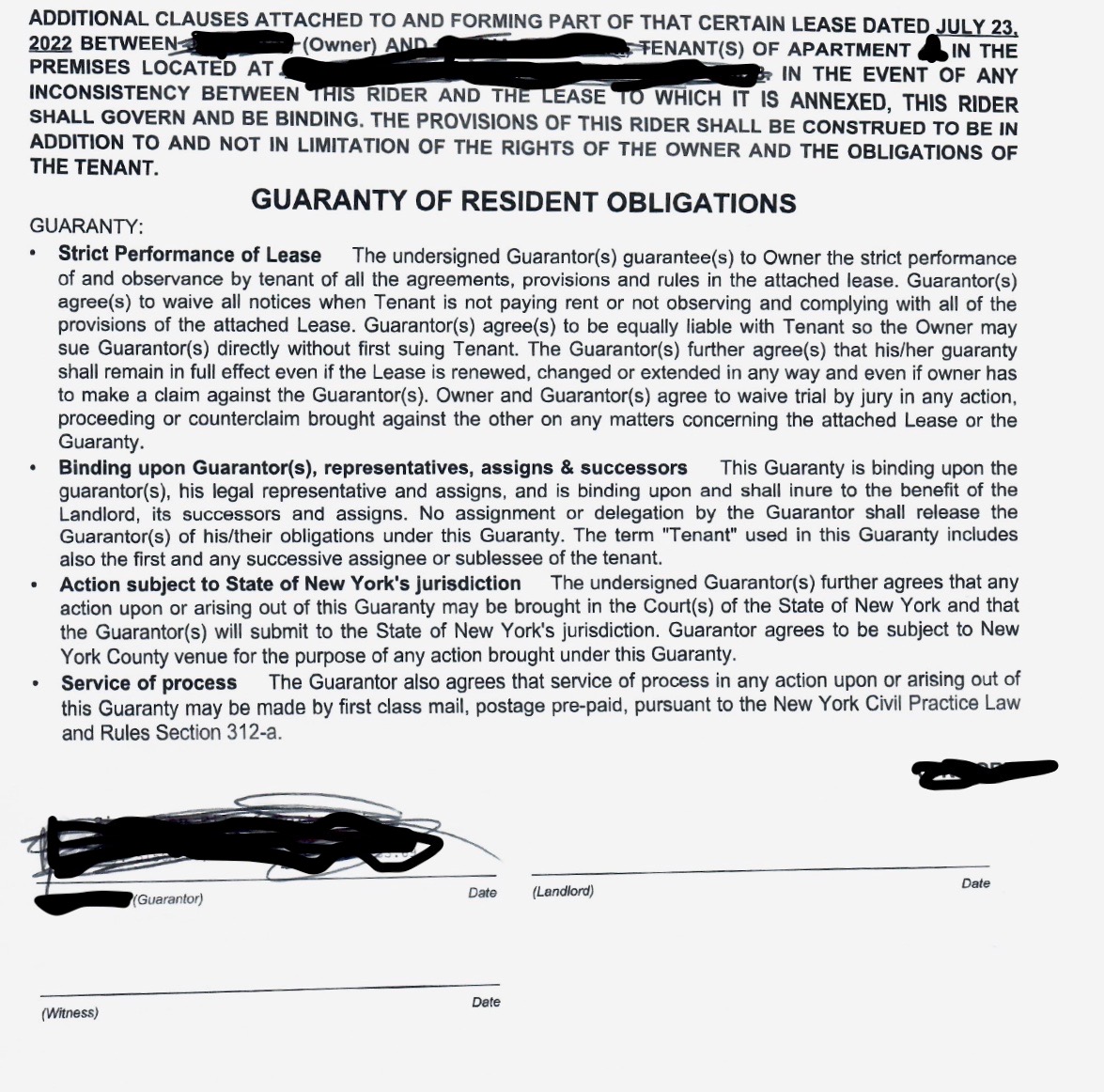

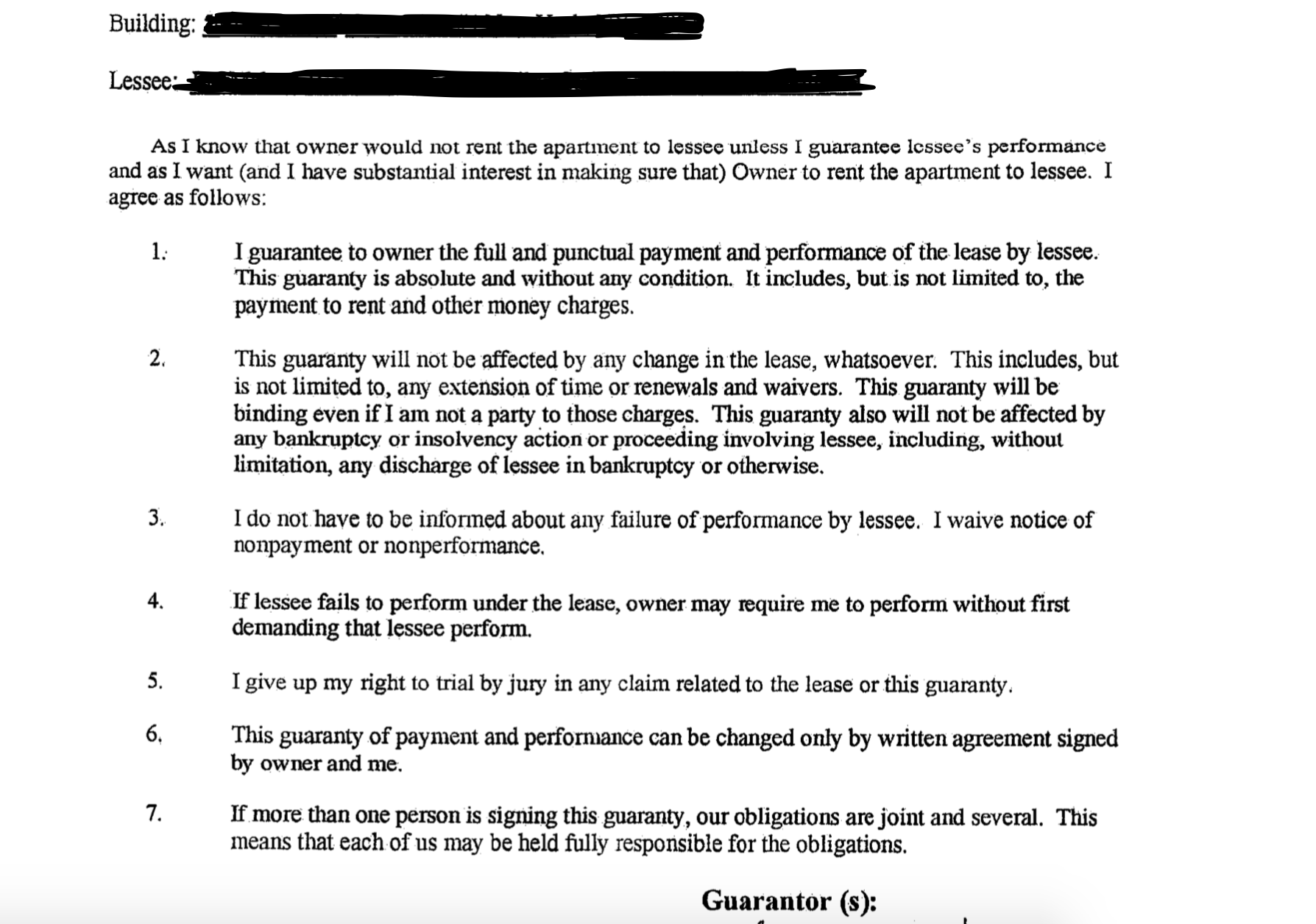

If you've been asked to be a guarantor for a New York City rental apartment, perhaps by a young relative, you may be wondering what you've gotten yourself into and the extent of your responsibilities. All this will be outlined in a document called a guaranty, which comes as a rider to the lease.

Brick obtained four sample guaranty riders—the wording varies slightly but they spell out your most obvious responsibility, which is to make sure the rent is paid in full and on time. However, you might be surprised to find out many landlords are under no obligation to tell you if the rent isn't paid or if the terms of the lease change. This means you are relying on the renter's communication skills.

In many cases, the only way a renter can secure an apartment, if they don’t meet a landlord's income requirements, is to have a guarantor involved. So if the person wanting you to step in as a guarantor is not earning at least 40 to 50 times the monthly rent, this is the route they will have to take. In terms of leverage, this means the landlord has the upper hand.

There’s very little room for negotiation

There is no standard form of lease guaranty, says Steven Kirkpatrick, a partner at Romer Debbas. “Just like there is no standard form of lease, each one is different,” he says.

If, however, you are hoping to negotiate with a landlord on the terms of the agreement you will probably be out of luck. "They are usually standard, boilerplate forms and if the tenant and guarantor don't sign as is, the landlord will likely give the apartment away—especially in this market," says Jennifer Rozen, managing attorney at Rozen Law Group.

That's certainly the case at DSA Property Group, a property management and development firm. Arik Lifshitz, the firm's CEO says, "The only points of negotiation are the term and price." Like many leasing agents, to streamline the business and reduce costs, the company doesn't hire lawyers to negotiate apartment leases. For a renter or guarantor who is offered a lease it's a case of take it or leave it. If you don't like the wording of the lease guaranty form, you will have to look for another apartment.

If you decide to go forward, the forms need to be signed and notarized.

You may not be alerted if rent is overdue

A common provision on a lease guaranty is that you agree to “waive all notices.” This means the landlord is under no obligation to tell the guarantor if the rent is late or in default. The reason for this, is that the more administrative tasks a landlord needs to complete, the more these various procedures can be challenged in court, which can defeat or delay any legal action.

“Much of the litigation in court is over notices: Was a notice sent? Did the notice have the proper wording? Was it sent in the right manner? To avoid that litigation, landlords want to minimize notices and file a court case as soon as possible,” Kirkpatrick says.

Depending on your landlord, this provision on the form can occasionally be negotiated. Kirkpatrick says it’s possible a landlord might agree that if there’s a rent demand they will also send the guarantor a copy. Landlords ultimately want the rent to be paid and sometimes copying the guarantor into late notices is enough to get the tenant to pay.

As an example, Adam Frisch, senior managing director at Mantus Real Estate, says in some cases, if a tenant with a guarantor is misbehaving—paying the rent late, leaving garbage out, or making excessive noise—a landlord may agree to email the tenants and copy the guarantor on the lease as a way of "scaring the tenants into behaving."

The agreement could be in place for many years

It’s possible you might sign a guaranty on the understanding the lease will be in place for one or two years, but in many cases if the lease is extended, renewed, or amended, you will continue to be the guarantor. Sometimes you might continue to be the guarantor even if the lease is assigned to another tenant. And the guaranty might state the landlord is not obligated to tell the guarantor about these changes.

“You could have a situation where a tenant signs a lease for $3,000, the market goes up, the lease gets renewed for $5,000 and the guarantor is still on the hook for that higher rent,” Kirkpatrick says.

Rozen says she always tries to amend the form to reflect that the guaranty is good only for the initial lease period and that "if there are renewals, in order for the guaranty to renew, a new agreement must be signed."

It's possible the agreement could be in place much longer than expected. For example, a guarantor for a tenant in a rent-stabilized apartment—where lease renewals are automatic—may be tied to the lease for 20 years or more.

Sometimes there can be guaranty that ends when possession of the apartment is delivered back to the landlord. This would cover a lease break situation. “That might be a possible point of negotiation and landlords might agree, especially now there’s an obligation to mitigate damages,” Kirkpatrick says. Under New York's rent laws, a landlord must do all they can to re-rent an apartment where the tenant breaks the lease.

In practical terms, taking a guarantor to court for unpaid rent in a lease break situation can be costly. Frisch points out that once the apartment is re-rented, the tenant's financial obligations come to an end. So if damages are mitigated and the landlord doesn’t have a claim against the tenant, they do not have a claim against the guarantor.

Equal liability opens you up to a lawsuit

When the lease mentions the tenant and guarantor are "jointly and severally liable," this means they have equal and separate liability. So a landlord is within their rights to go after both the tenant and the guarantor, equally and individually for unpaid rent and damages. “It is very unusual for a guaranty rider to require that the landlord pursue all remedies against the tenant first,” Kirkpatrick says.

The typical guaranty agreement makes the guarantor liable for the rent immediately after it comes due. This means if the rent is due on the first of the month and the tenant doesn’t pay, the landlord can file a court action against the guarantor on the second of the month.

“Going after a guarantor is typically faster than going after a tenant for eviction,” Kirkpatrick says.

Waiving a trial by jury

The guaranty form typically says the parties waive trial by jury if there's a lawsuit. This is very standard wording and Frisch says it's aimed at reducing the legal costs for a landlord in the event of a litigation. A landlord is unlikely to negotiate on this point.

Non-monetary obligations can be significant

Frisch says in practical terms, if a landlord has possession of the apartment they are only likely to take a guarantor to court if there was significant property damages—a destroyed kitchen, holes in the wall, or illegal activity. "This would have to be, if not criminal behavior, certainly very disruptive behavior on a civil level, which doesn't happen very often," he says.

Damages to the property would fall under non-monetary obligations. This is something to look out for in the guaranty rider. “If the tenant did not maintain the apartment, the guarantor is on the hook,” Kirkpatrick says.

Non-monetary obligations might be “very significant” Kirkpatrick says, especially in a situation where the tenant is doing something unlawful, like illegal Airbnb rentals. If the landlord is faced with violations and fines by the city, Kirkpatrick says the guarantor could be sued and there might be hefty financial consequences.

Using an institutional rather than an individual guarantor

When a renter doesn't have an individual guarantor willing to step in, the alternative is an institutional guarantor, a company offering the same service for a fee. Insurent is one of these companies and is also a Brick Underground sponsor.

"Insurent does not sign the lease as a typical individual co-signer would," says Jeffrey Geller, Insurent's vice chairman and chief operating officer. Instead, they have a master policy with each rental building and issue a guaranty for each specific lease under the master policy.

"Landlords and owners solely accept the Insurent program—at no cost to them—and renters pay the guaranty fee, and Insurent covers the full rental obligation under the lease," Geller says.

You Might Also Like