Airbnb isn't necessarily causing city rents to spike—yet

While recent reports found that Airbnb "commercial listings" are already raising rents in popular neighborhoods like Chelsea, Bedford-Stuyvesant, and Williamsburg, a new data dive from number-crunching giant FiveThirtyEight indicates that this isn't really the case just yet, but that the short-term rental giant still has plenty of potential to upend urban housing markets.

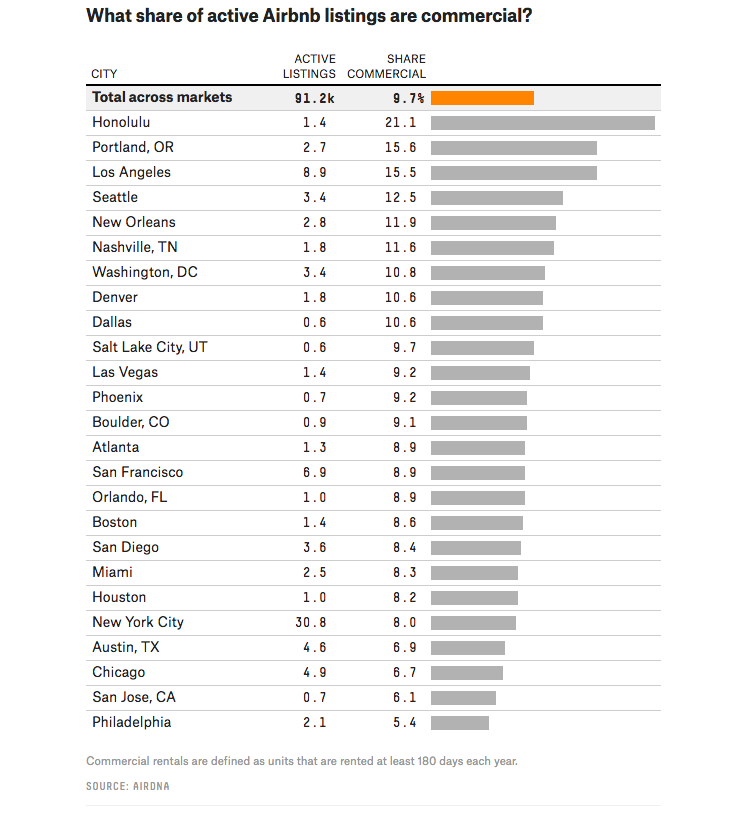

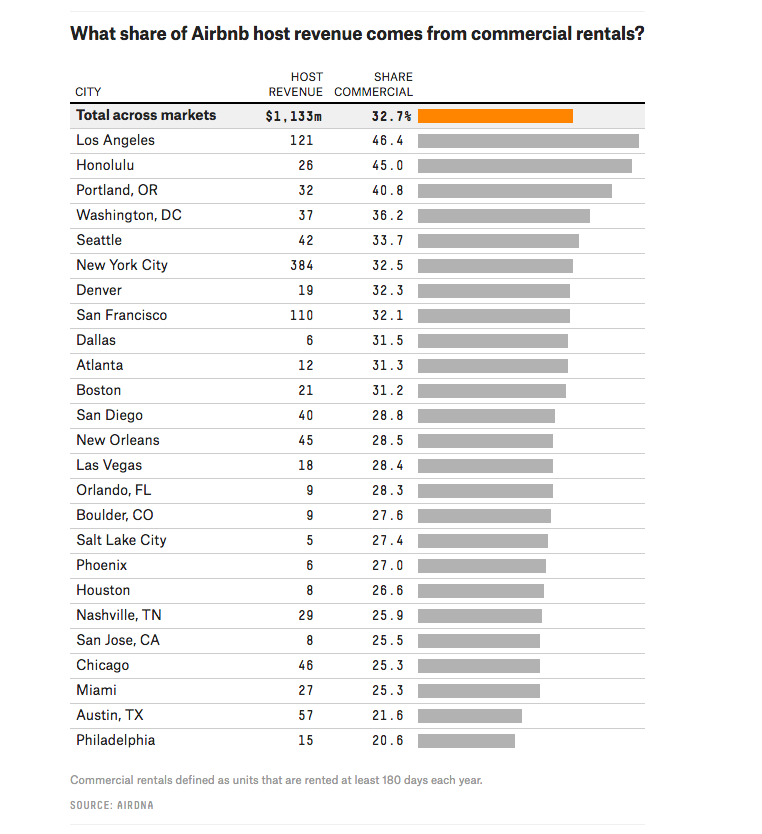

Through data provided by consulting firm Airdna, FiveThirtyEight found that while "commercial listings"—apartments and homes that are rented out for the majority of the year—make up just 10 percent of Airbnb's listings nationwide, they account for around 30 percent of its total revenue. Why is this of interest? Because "commercial listings" are thought to remove much-needed housing stock from the market, exacerbating tight demand and bumping rental prices upward. (After all, an apartment that's constantly being rented out on Airbnb is an apartment that can't be rented out by a full-time neighborhood resident.) And if these listings are a prime source of revenue, then Airbnb is likely to try to make them a larger percentage of their listings, a move that could drastically affect housing markets in cities like San Francisco and New York where the site is most popular. ("Airbnb disputed the analysis but declined to provide its own data," FiveThirtyEight somewhat shadily notes in their post.)

That said, since the current number of commercial listings is low—around 2,500 in NYC, and less than 1,000 in most cities—they likely don't have an appreciable effect on rents as of yet. "It's a very valid concern," Stockton Williams, executive director of the Terwilliger Center for Housing at the Urban Land Institute, told the site. "But I'm not sure if there is evidence that Airbnb has had a significant effect on either price or supply."

And while Williams says there's "no question" that the rate of commercial listings on the site is growing, these stats are difficult to track, as Airbnb declines to release them, and, as FiveThirtyEight points out, there's no widely accepted definition of a commercial listing to clearly define the parameters. (For the purposes of this study, FiveThirtyEight used the Attorney General's metrics, which count a rental of an entire home or an apartment that's rented for 180 days a year or more as commercial.)

But as Airbnb continues to court full-time hosts (and even tries to broker deals with landlords to expand the service), it seems all but certain that these full-time listings will become a larger share of the market—and in turn, start to affect your bottom line as a renter.

You Might Also Like