The Fair Housing Act protects non-English speakers, HUD has clarified

Some welcome news for renters: The U.S. Department of Housing and Urban Development (HUD) has made it clear that it's a violation of the Fair Housing Act to discriminate against residents who speak limited to no English, CityLab reports.

The Fair Housing Act already protects renters and buyers from discrimination based on "race, color, religion, sex, disability, familial status, or national origin," and the latest guidance issued by HUD clarifies that though it's not explicitly covered under the act, a person's status as an English-speaker should also be considered a protected category. The reasoning is simple: that discrimination based on Limited English proficiency (or "LEP") is just another version of discrimination based on national origin.

"Having a limited ability to speak English should never be a reason to be denied a home," Gustavo Velasquez, HUD assistant secretary for fair housing and equal opportunity, explains in a press release. "Every family that calls this nation home has the same rights when it comes to renting or buying a home, regardless of where they come from or language they speak."

HUD's memo also notes that "a person's accent and his or her national origin are 'inexctricably intertwined.' It is thus inconceivable that a housing decision that treats someone differently because he or she speaks English fluently but with an accent is anything but intentional discrimination because of national origin in violation of the Act. The same is true for housing-related policies or practices that treat persons with certain accents different than persons with other accents."

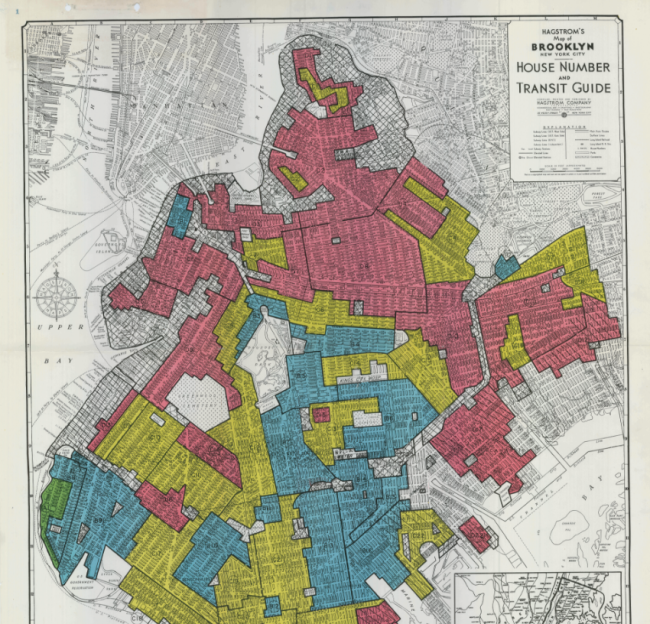

The latter portion of the memo also hits out at predatory housing services (such as loans and insurance) marketed toward immigrants or those who speak limited English: "This is akin to 'reverse redlining,' where a service provider, such as a lender or insurer, targets a group of persons who share a race or national origin, or targets an area where most of the residents share a race or national origin, for the extension of credit or insurance on unfair or illegal terms."

Given that major lenders still get in trouble for charging higher interest rates to minorities, the fact that HUD just made them easier to sue (and prosecute) is a big step in the right direction.

You Might Also Like