How inequitable property tax assessments lock in 'institutional racism'

Mayor Bill de Blasio is looking to jumpstart his property tax reform platform before he leaves office.

iStock

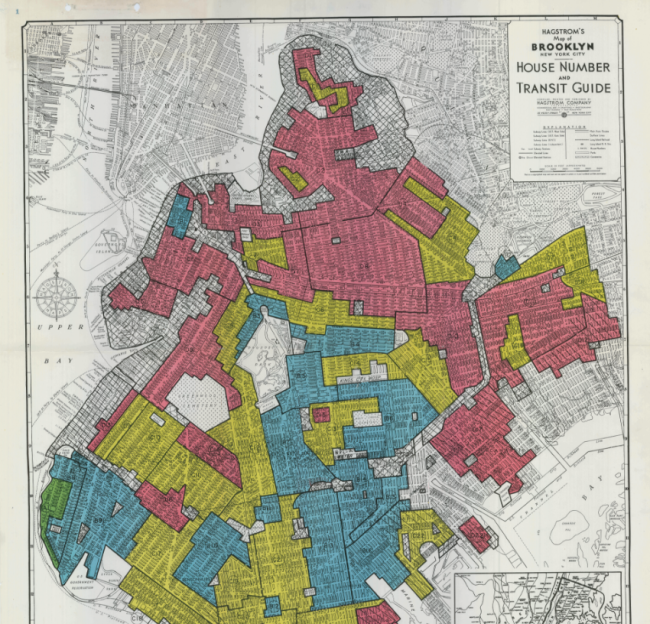

Homeowners who are Black pay a disproportionate amount of the U.S.’s $500 billion annual property taxes as a result of an unfair valuation system. It’s a problem that stretches back until at least the 1970s, and a new article from Bloomberg illustrates its devastating effect.

In cities across the U.S., because of outdated, inequitable property tax systems, valuations favor the wealthy at the expense of poor, often minority populations. These valuations give the least expensive residential properties in New York City an effective tax rate that is three times higher than the most expensive homes, the article says.

Unfair tax burdens can mean unpaid bills, property seizures, and the lost opportunity to build generational wealth, while at the same time benefiting real estate investors who scoop up low-priced properties. The piece cites a University of Chicago professor who led a 2020 study of 2,600 U.S. counties and found 90 percent deploy what he calls "a textbook case of institutional racism."

The Bloomberg article also presents a homeowner in East New York, Brooklyn—the house she bought for $93,000 in 1998 was assessed at $380,000 for the 2014-2015 tax year. Meanwhile a doctor who owned a house that he paid $3 million in wealthier Clinton Hill, Brooklyn, was assessed at less than half, or $1.2 million—meaning his bill was only one-third higher, even though his house was worth eight times as much, the article explains.

Reforming NYC’s property tax system has been discussed for many years—it was a campaign pledge of Mayor Bill de Blasio in his 2017 re-election. In early 2020, a mayoral commission proposed major changes to make the process more fair‚ but they were put on hold because of the pandemic.

Now de Blasio is looking to jumpstart his tax reform efforts before he leaves office. He’s looking to restart hearings and create some recommendations before the end of his term, The Real Deal reported. He would need the approval of the state legislature to make them stick.

But he was criticized for doing too little, too late, according to The Real Deal.

Martha Stark, policy director of Tax Equity Now New York, says the mayor had “six years to make the property tax system fairer for those who were also hardest hit by the pandemic: Black and brown people, the working class, small businesses, and renters,” the article reported.

You Might Also Like