Mayor Adams is bringing the tax lien sale back. Here’s how to get your property off the list

- NYC's tax lien sale outsources the collection of unpaid property taxes and other housing bills

- There are exemptions if you are a senior, veteran, or have a disability as well as payment plans

Warning notices are sent in the mail 90, 60, 30, and 10 days before the tax lien sale to notify owners that if bills are not paid, the debt will be sold to a private trust.

iStock

If you’re an owner who has fallen behind on your bills for property taxes, water, sewer, or for emergency repairs, or you’re a renter who lives in a building where the owner is delinquent on the same charges, the clock is ticking.

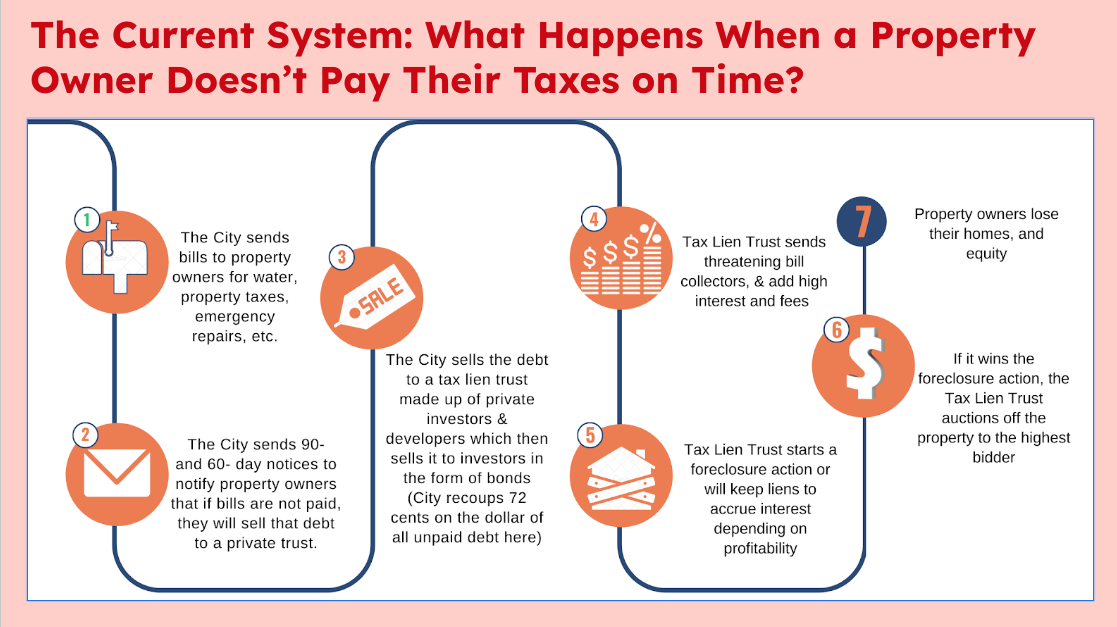

For the first time since 2021, Mayor Eric Adams is gearing up to hold a tax lien sale, a 1996 creation of the Giuliani administration that outsources the collection of unpaid property taxes and other housing bills. The sale enables owners' debts to be sold to private investors who tack on high interest and fees and go after you for the inflated amount. If you do not pay, you can ultimately lose your property in a foreclosure auction.

With less than 60 days to go until the May 20th sale, 21,372 residential properties citywide are on the list—that’s down from the 90-day list of 24,017 for properties in Class 1 (one- to three-unit houses) and Class 2 (co-op, condo and rental buildings with four-plus units).

Housing advocates said it’s critical for owners on the list to act before their liens are sold. Warning notices are sent in the mail 90, 60, 30, and 10 days before the sale to notify owners that if bills are not paid, the debt will be sold to a private trust.

“We see a lot of people on the lien sale list who shouldn’t be there,” said Rachel Geballe, a supervising attorney with the Neighborhood Economic Justice Project of Legal Services NYC’s Brooklyn office. These may be owners who are entitled to an exemption because they are a senior, veteran, or have a disability.

Owners can lose their exemptions “because you have to recertify and they struggle with paperwork. Many who come to us are eligible to be removed, but a lot has to happen to get off the list,” Geballe said.

How the lien sale operates

The sale process involves the City of New York pooling eligible liens and transferring ownership to a trust; the trust (whose sole beneficiary is NYC) then uses bill collectors to go after the debts. The trust uses funds raised from bond sales to investors to buy the city’s liens at a discount. In the past the discount has been about 72 cents on the dollar, according to a 2024 report from Center for NYC Neighborhoods.

“By transferring the ownership of its liens to a trust via a bulk sale, the bonds used to purchase the liens are more appealing to investors, but that comes at the expense of oversight and accountability to ordinary New Yorkers,” the report noted. “This system was originally put into place to circumvent the city’s debt limit concerns and is no longer relevant today, yet still impact New York City’s most vulnerable homeowners.”

Want to see the public records of your building in one unified report? Check out the Brick Report, our background check on any address in New York City.

Why is the tax lien sale problematic?

Once a tax lien is sold, a third-party collection agency can add fees and annual interest of up to 18 percent, compounded daily. That means owners who face liens can fall even farther behind. Next the tax lien trust can start a foreclosure action; if it wins it can auction the property to the highest bidder.

The tax lien sale has been shown to disproportionately impact owners in communities of color and lower-income communities.

A report by the Coalition for Affordable Homes found nearly two-thirds of the lien sales sold in the 2021 sale were in areas where over half of owners identified as non-white or Hispanic. Over one-fourth of the lien sales were in areas where owners reported incomes of less than $75,000.

Unaware they are on the list

Some owners may not be aware they are on the tax lien sale list, said Kevin Wolfe, deputy director of advocacy and public affairs at Center for NYC Neighborhoods. That’s because this is the first time the sale is being held since the pandemic, and owners who received a notice in the mail may not understand its significance, he said. (The lien sale was paused in 2020.)

A disproportionate number of small owners are represented on the list, 42 percent, even though that number reflects 20 percent of total buildings, Wolfe said.

He said owners on the list typically have paid off a mortgage or have a reverse mortgage and are often seniors—or their heirs.

“They’re not used to receiving notices from the city,” he said.

When liens are issued

Owners who are behind on their property taxes, water bills, or emergency repair bills—for example if tenants lacked heat and the city replaced the boiler—can be put on the list.

According to Center for NYC Neighborhoods, for one-family houses, a tax lien can be sold if an owner has sustained a debt of at least $5,000 for over three years. If you only owe water/sewer charges, but not property taxes, the city cannot sell a lien on your property; however, DEP may terminate your water/sewer service if the charges remain delinquent.

For two- to three-family homes, condo and co-op buildings, a tax lien can be sold if an owner has sustained a debt of at least $5,000 and those charges are three years overdue. A water or sewer lien of at least $3,000 can also be sold if those charges are one year overdue.

How you can get off the tax lien sale list

The Abolish the NYC Lien Sale Coalition, a group of 10 housing advocacy groups and community land trusts, is sounding the alarm about the harms perpetuated by tax lien sale and multiple options that owners can use to remove themselves from the tax lien sale list. The group is holding community briefings to get the word out; the next one is scheduled for April 3rd at 6 p.m.

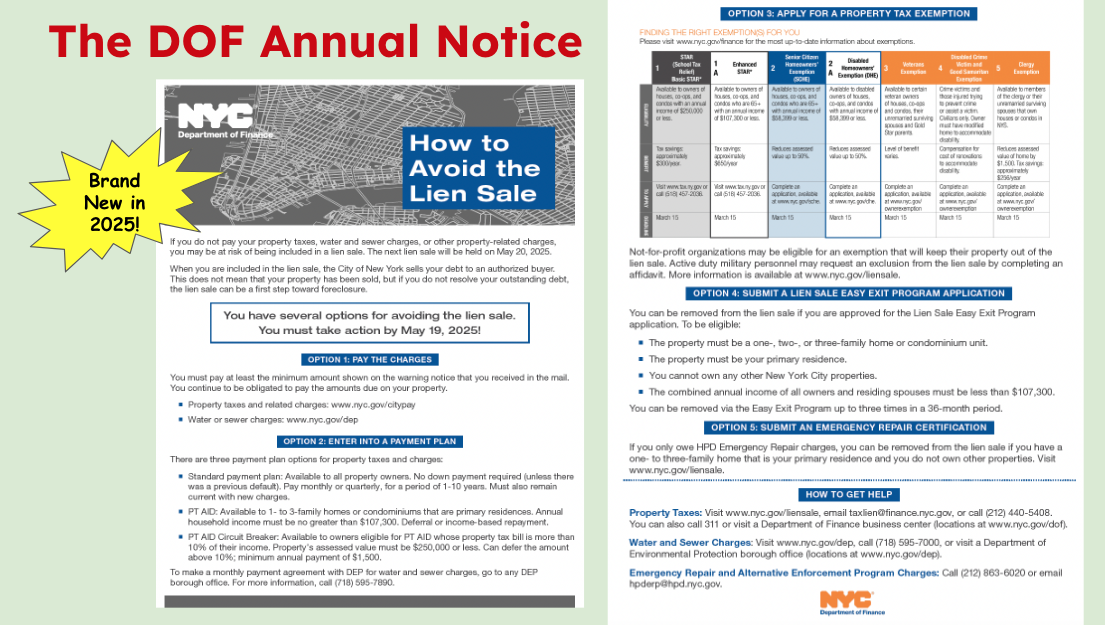

The coalition was successful in getting legislative reforms passed in the City Council last year to reduce the list. For example, households that make less than $107,300 in 2025 can now use the Easy Exit form to have the property removed from the lien sale three times in 36 months.

Other new options include deferring city debt or making income-based payments through Property Tax and Interest Deferral Programs (PT AID) as well as the senior citizen homeowners exemption (SCHE), disabled homeowners exemption (DHE), veterans exemption, or not-for-profit exemption.

Ultimately, the coalition wants the lien sale to be abolished.

“We’ve been shrinking the lien sale. My hope is that the city thinks eventually that it’s not worth it, but I’m not holding my breath,” said Paula Segal, senior staff attorney in the Equitable Neighborhoods practice at TakeRoot Justice, during a recent community presentation.

In a phone conversation with Brick, Segal noted that Mayor Adams was bringing back the lien sale after four years, even though the city could have created a new system for debt collection instead of outsourcing the process again and making money for investors. His budget office estimates bringing in $80 million each year over the next four years from the lien sale.

“Peanuts,” Segal said.

During a City Council hearing in June on a bill to implement reforms to the tax lien sale, City Council member Justin L. Brannan noted, “the Council has been and remains willing to let authorization for the lien sale expire rather than collect funds at the expense of driving foreclosure and homelessness among our most vulnerable.”

‘Phone book for speculators’

One change Segal would like to see is to end the public release of the lien list, which she called a “phone book for speculators.”

That's because it readily identifies vulnerable and desperate owners to con artists. Intro 783-2024 is a City Council bill that would record debt without a need for the lien sale and replace the public lien list with individual recordings in ACRIS, the city's property database.

To Geballe, “it’s one of the worst things about the lien sale—publishing the names of everyone who is behind on their bills.” She advises owners who are facing liens that they are going to get a lot of calls and that they should only accept help from trusted sources.

“Any offer of help in exchange for money is a scam,” she said. In 2024, $2 million a year in public funding was set aside for outreach and free legal counseling for owners and tenants affected by the lien sale through the Center for NYC Neighborhoods.

There are numerous ways off the lien list, and getting the right help can make a critical difference.

Geballe said she had an elderly client who was also blind and had fallen behind on payments. Instead of being given an exemption, she had been put in a payment program she couldn’t afford.

She was on her way to losing her property, but a legal services attorney was able to straighten matters with the Department of Finance in time and get the sale of her lien out of foreclosure, which saved her property.

What you should do if you’re a renter

Renters can also be displaced by the lien sale. This scenario typically involves landlords who collect rents but do not pay their bills and ignore fines—they are betting on selling for a large sum—and they end up on the lien sale list

A new reform requires NYC’s Department of Housing Preservation and Development to do direct outreach to tenants in buildings that have landed on the lien list.

In addition, rental buildings that are in distress are supposed to be taken out of the lien sale. If there are problems in your rental building, contact HPD through 311 to file a complaint. This will help the city flag your building.

The coalition is pushing for legislation that would enact a city foreclosure program to protect tenants in rental buildings with negligent landlords by replacing the landlords and creating co-op conversion opportunities.

Bottom line

If you got a lien notice in the mail, don't ignore it. You can:

1) Pay what you owe. For property taxes and emergency repair charges, go to CityPay. For water or sewer charges, go to DEP's website.

2) Get on a payment plan. There are three options: Standard payment plan for all property owners, regardless of age or income; PT AID payment plan if you earn $107,300 or less per year and meet other requirements, or PT AID Circuit Breaker payment plan if you meet the income cap above and your property tax bill is more than 10 percent of your income and your property’s assessed value is $250,000 or less. If you are approved for one of these plans, you may also be eligible to pay a reduced interest rate.

3) Apply for an exemption: senior citizen homeowners exemption (SCHE), disabled homeowners exemption (DHE), veterans exemption, or a not-for-profit exemption.

4) Apply for an Easy Exit.

5) File an emergency repair certification.

You Might Also Like