10 questions to ask if you’re a prospective buyer worried about climate change

- Figure out if your potential building is in a flood zone before you go see it in person

- Consider the costs of extreme weather, like upgrades, flood insurance, and repairs

It can feel intimidating to try to consider a global phenomenon in our individual choices. But there are a handful of things to look for when buying.

iStock

Buying an apartment in New York is already more expensive and complicated than many other cities. Now, climate change has the power to make that process even more of a headache.

Global temperature rise is likely to make storms, heat waves, and extreme weather more frequent and more intense, and it’s something New York City’s residents are becoming more aware of—and not just during hurricane season.

“We definitely have seen a younger pool of homebuyers engaging with both the education and resiliency at large,” says Christopher Zimmerman, a senior program manager at the Center for New York City Neighborhoods, a nonprofit that supports NYC affordable ownership. “Younger homebuyers definitely seem aware and more educated on flood risk and things like insurance,” he says.

Climate change is unpredictable, and it can feel intimidating to try to consider a global phenomenon in our individual choices. But there are a handful of things to look for when buying a property or moving to a new neighborhood that can help mitigate its risk. You can look at a building’s flood zone, history of past flooding, the age of its mechanicals, and its insurance requirements to figure out what property is right for you.

Read on for a list of questions to ask an owner, realtor, developer, or to look into yourself when considering climate change in your home-buying process.

[Editor’s note: This story is part of an ongoing series about how buyers can take climate change into account. You can read our stories about evaluating a building’s and a neighborhood’s climate change risk and the weatherization assistance program. If climate change was a part of your buying process, send us an email here. We may contact you for future stories.]

1. Is the building in a flood zone?

Before you get to the front door, you should know whether a property you are touring is in a flood zone, Zimmerman says.

For anyone who is apartment or house hunting, “I always advise them to know the flood zone, know the layout, know the history of a property you’re looking at before you walk in,” Zimmerman says. “Once you see a place, it’s kind of hard to divest yourself—if you like it—of some of the harder parts.”

You can do your own research online by searching the Federal Emergency Management Agency’s (FEMA) flood maps or the Center for New York City Neighborhoods’ online search tool, FloodHelpNY to find out more about the property’s flood zone.

2. Does the property have a history of flooding?

Make sure to ask your agent or the previous owner about flood history, as even properties outside flood zones can become inundated thanks to heavy rainfall or clogs in the city’s sewer system. (A proposed bill would require sellers to disclose whether their properties have been flooded or are at risk for future flooding.)

You can also search NYC’s rainfall-based flood maps online and uncover if the building is on an underground river, which can cause basement flooding.

3. Where are the building’s mechanicals stored?

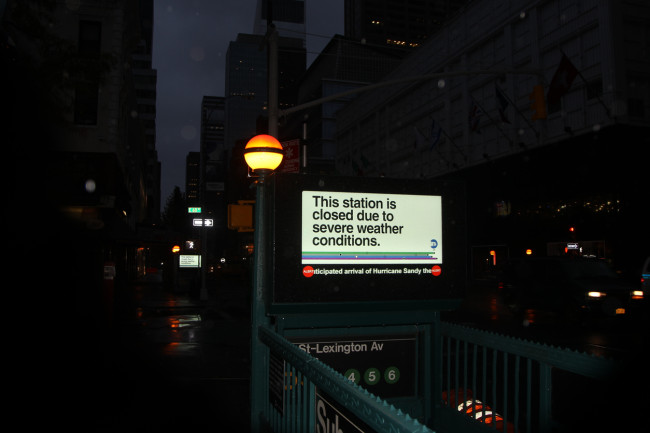

A building’s mechanicals are at a higher risk of flooding if they sit in the basement or the ground floor, something that Hurricane Sandy drove home to many New Yorkers.

It’s a good idea to know where the mechanicals are stored, even if you’re not in a flood zone, Zimmerman says.

4. Are there any amenities on the lower floors?

Basement amenities can also be at risk of flooding, and it’s important to check out what could be at risk during a flood, says John Walkup, co-founder of real estate data company UrbanDigs. Laundry, storage, or a building’s gym could be out of commission thanks to severe weather, resulting in an annoying inconvenience or a potentially expensive fix.

5. Does this property have a flood insurance requirement?

Residents living in a high-risk flood zone with a federally-backed mortgage and those who previously took federal disaster assistance for flood damage are required to have flood insurance in New York, according to the city.

It’s important to know your insurance requirements so you can meet them, and so you’re aware of the additional costs of home ownership. FEMA’s National Flood Insurance Program costs an average of $700 per year nationally, though Forbes estimates the average cost in New York is closer to $1,144 per year.

6. How could flooding affect the property’s value?

This question comes from Maryana Grinshpun, a founding partner of architecture and design firm Mammoth Projects, who is considering buying an apartment in the next two years. (FYI, she’s also a Brick sponsor.) Buying an apartment is a significant purchase, and Grinshpun recommends considering how flooding—or other weather events—could impact a property’s value to determine how safe an investment is in the long run.

“What I’m most concerned about is how my investment is going to hold up over time,” Grinshpun says.

7. How close am I to areas with air pollutants?

NYC’s air quality is fairly good for a major metropolitan city, but air quality will vary by location—including proximity to polluters—and by season. Air pollution from vehicles in particular can increase the likelihood of illness from heart and lung diseases, and has a disproportionate impact on minority communities more likely to live near roadways.

Grishpun recommends thinking about a home’s proximity to highways, especially for those with young children. You can also use the NYC Community Air Survey’s online map to check out a neighborhood’s air quality.

8. How old are the building’s HVAC, heating, and cooling systems?

Outdated mechanicals can be expensive to replace—regardless of climate change. It’s worth checking out your building’s mechanicals and asking the agent, owner, and board about the property’s infrastructure in case serious repairs will be needed in the future.

9. What costs could grow as climate change worsens?

Climate change is unpredictable, and it could become more expensive to respond to worsening storms over time. Homeowner’s insurance costs could rise in NYC—something a buyer should be aware of before making a purchase, Walkup says.

“If your building is in a flood zone, or near a flood zone, you might be paying significantly higher insurance,” says Walkup. “You may have to figure out what's gonna happen to your maintenance [costs]... because in the next couple of years, a building might be paying a lot more for insurance than they banked on.”

10. How much time and/or money am I willing to invest in climate-proofing upgrades?

Co-ops and condo buildings are already embarking on upgrades to their buildings to comply with Local Law 97, a rule that caps carbon emissions for NYC buildings. But other climate-proofing methods, like waterproofing your basement or upgrading your mechanicals, might become necessary depending on the age of your building.

You should ask your condo or co-op board what projects they have in the works, or what they’re planning to attempt. If you’re buying a condo, you should ask if the building has done a reserve study—an assessment of the cost of repairs or upgrades to a building—which can help tell you more about future costs. There are resources available to fund climate-adaptation measures to low-income communities, such as the federally-funded weatherization assistance program.

You Might Also Like