Test drive: 4 expense-sharing apps to keep the peace between roommates

The more roommates you have, the less rent you have to pay at the end of the month. Ditto on electricity, cable, and internet. But with billing for utilities done under one name and only a couple of roommates named on a lease, keeping tabs on the money flow (especially if there are three or more roommates) isn’t easy. Fortunately, technology is on your side, with a smorgasbord of online tools to help you keep track—sending invoices, collecting money, and updating your roommates with notifications on when they owe.

[This article was last updated in June 2017. We are presenting it again here as part of our end-of-year Best of Brick week.]

Brick Underground test-drove four expense-splitting tools, each aiming to ease the administrative headache of those pesky bills, bills, bills. Here's the lowdown:

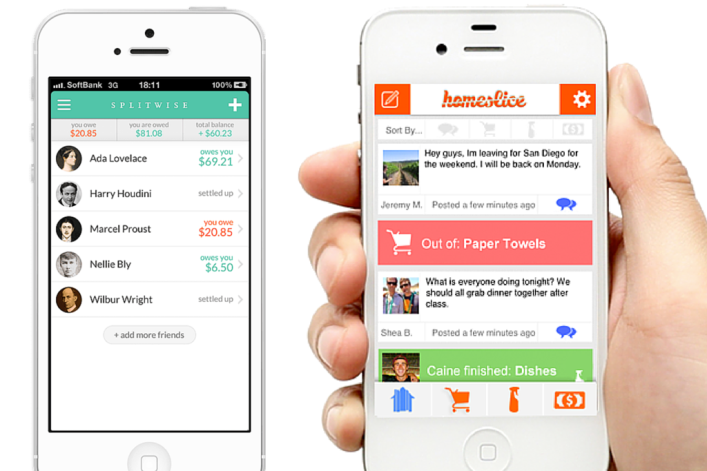

1. Splitwise (free)

This straightforward web tool and smartphone app lets you easily add friends based on phone number or e-mail, then input the total amount of a bill and a description and divide equally by a percentage or “shares.” It does all of the math for you, sends notifications, and allows you to send reminders. You can upload photos of your bills, but you can’t pay via the app, meaning you’re still stuck with cash, checks, or money transfers via PayPal or services like Chase QuickPay and Venmo (see below).

When roommates pay, just click “settle up” to subtract how much they’ve paid. This will keep a running tally of debts in a simplified list form. The option to sort your roommates into groups makes everything seamless—whenever you have a new expense, just add all of them with one click. The interface is simple, too. It takes one click to add a bill, and the home screen of the app shows you how much you’re owed at any given time. There is also a “remind” button to send amounts due, it’s simple to use, and is a great way to keep bills organized. Now, if only there was a way to pay within the app, it would be perfect.

2. Venmo (free)

Venmo is purely a payment tool that allows you to send and receive payments on your phone, which can easily be used in conjunction with an organizational bill app like Splitwise (above). The app keeps track of payments, then you “cash out” via your bank account, just like you would with PayPal. Once someone owes you or you owe them, you type in his or her phone number or email, write what the payment is for, and “charge” the person. You can also do the same to pay someone else—one form does it all. From there, you “cash out” and the money goes right to your account. For payments, you can use your debit card or bank account for free, or you can pay a 3 percent fee to use a credit card.

To save time, you can add friends who you share payments with often, plus a circle of “trust.” (For those in the elite circle, you don’t have to approve payments—they can automatically withdraw.) You can also import Gmail contacts, use Facebook friends, or use your general contact list. It sounds scary to offer up this much personal information, but, as Slate notes, “All data is sent over a 256-bit encrypted connection—the same encryption method used to protect classified government information—and transactions are protected by the Federal Deposit Insurance Corporation.” You can also lock the app with a pin, and/or use Touch ID (iPhone only).

3. RentShare (free)

RentShare isn’t technically an app (it's an online tool) but it's easy to use, accessible on your smartphone, and allows you to split bills and actually pay your rent directly to your landlord electronically.

Accounts are free and the program allows you to add your monthly rent and shared expenses (i.e. cable, electricity, and internet), all of which are totaled on one account balance. For example, if your rent is $1,000 each and you pay $150 for cable and internet and $100 for electricity, everyone’s share would automatically be adjusted, even if everyone pays a different amount in rent.

As for paying your landlord, once you pay online—from a bank account, there is a $1.95 fee, and for credit and debit cards, you incur a 2.9 percent service fee—a check and a detailed letter is sent to your landlord or property management company. They don’t need to have an account to use RentShare. The amount is automatically drawn from your account after you pay (instead of having to wait for them to cash a check), and they even send you a reminder before it’s due.

You can’t pay other companies like Time Warner or Con Ed with RentShare, but you can add them as “expenses” and email roomies an invoice for them to pay you, keeping track of them all on the easy-to-use interface. While this isn’t a one-stop shop for bill shares, the idea of not having to collect checks at the end of every month for rent (and hoping no one forgets) may well be a luxury worth $1.95.

4. SquareCash (free)

This option is like a more no-frills version of Venmo, and lets you send cash directly from person-to-person using your bank account, debit card, or credit card (there's a three percent fee for credit card transactions). Unlike Venmo, there's no emoji-filled social feed of your and your friends' transactions, but the app will save contacts you've transacted with previously, and you can search by name, phone number, or email to find contacts.

The cash-out process is somewhat faster than Venmo, as money usually hits your account the next day after cashing out (and you can select an option for automatically cashing out, instead of taking the extra step to request the transfer). For a one percent fee, there's also an option for an instant deposit. For security, the app has PCI-DSS level 1 certification for data encryption, and you can enable a Touch ID lock, or a CVV code.

The bottom line: To adopt a totally electronic approach to expense sharing, use something like Splitwise to keep track of your expenses and payments, then use it in conjunction with Venmo, SquareCash, PayPal or a bank program like Chase QuickPay.

You Might Also Like