Returning to the office for some Wall Streeters means moving back to NYC

- Hybrid no more: Unpredictable in-person work schedules mean daily commutes from far-flung suburbs are unappealing

Some employees are returning to NYC full-time, others are keeping their primary residences outside the city and buying or renting a smaller apartment in the city near Midtown or Downtown.

iStock

Is the end of hybrid work at Wall Street firms giving the New York City real estate market a boost?

Financial firms that had flexible work-from-home policies are joining the return-to office trend and requiring more workers to be in the office as many as five days a week. For employees who moved to the suburbs because they could work hybrid schedules, having to be in the city more days appears to be fueling a small burst of real estate activity.

Several brokers told Brick Underground they’re working with Wall Street workers on apartment searches because of updated RTO mandates. What they’re hearing: Long, often unpredictable in-person work schedules are tough on employees who need to conform to commuter train schedules.

‘Daily commute too demanding’

Jared Antin, managing director and broker at Elegran/Forbes Global Properties, said he’s currently seeing some increased demand for NYC real estate, but the impact is not as significant as it was when major firms initially required a consistent in-office schedule of two to three days a week.

The trend he’s seeing now: New Yorkers who relocated outside the city and commuted three days a week find “the daily commute too demanding.”

Some employees are returning to NYC full-time, others are keeping their primary residences outside the city and buying or renting a smaller apartment in the city near Midtown or Downtown.

“A client of ours who works at a large financial institution in the Financial District and moved to Greenwich during Covid is in the process of selling their Greenwich home. They leased a high-end rental in the Financial District and will move in later this summer with the family,” Antin said.

New surge in leasing

It’s a trend that’s hard to quantify and some brokers told Brick they haven’t seen demand from Wall Street clients. Others said there’s no way to distinguish the latest impact from the banking sector because of its timing during the spring, when leasing is up anyway.

While it is tricky to definitively pinpoint the cause, there has been surge in leasing this year, one that lines up with the most recent RTO activity, said John Walkup co-founder of the real estate analytics firm UrbanDigs.

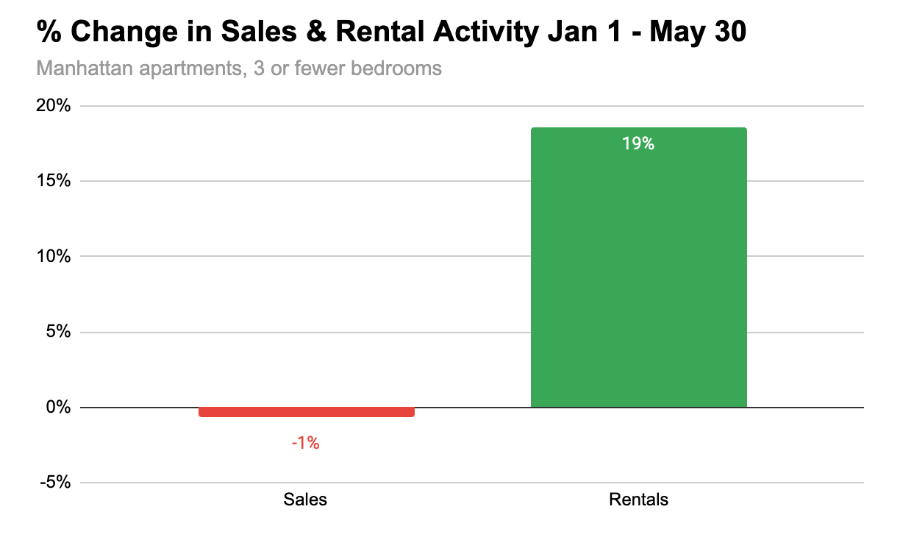

He compared the number of reported leases signed for units with three or fewer bedrooms in Manhattan from January 1st through May 30th in 2024 vs. 2023 and found leasing is up nearly 19 percent. (Sales are down 1 percent for the same period.)

Source: UrbanDigs

NYC rents are trending up

Returning New Yorkers will find the rental market far more expensive and competitive now.

One unusual hallmark of the NYC rental market these days is a negative listing discount, which means on average, renters are offering to pay more than the landlord is asking in order to beat the competition. Manhattan median rent was $4,250 in April, 0.2 percent increase over April 2023, according to the latest edition of the Elliman Report.

Ordered back to work

In late May, Citigroup, HSBC, and Barclays ordered more workers to report to the office five days a week, Bloomberg reported. It’s not a demand for all employees, however. Citigroup asked 600 U.S. employees who are eligible to work remotely to return to the office full-time. The majority of Citi employees will continue to work on a hybrid schedule, the firm said in a statement.

Similarly, Barclays mandated its global investment banking staff work in the office or meet clients five days a week starting June 1st. HSBC considering changes that would impact almost half of its workforce in New York, around 530 employees, according to the report.

The three banks were considered to have the most flexible policies on remote work. At the other extreme are Goldman Sachs and JPMorgan Chase, which in 2021 called back most workers five days a week. Bank of America made a similar shift in 2022.

‘Everyone is looking’

Kunal Khemlani, an agent at The Corcoran Group, is working with two different Wall Street workers who need to be back in the office more days each week.

He noted that some firms previously announced new rules and now are enforcing them. Financial firms pointed to new monitoring regulations from the Financial Industry Regulatory Authority (FINRA) that went into effect May 30th. But FINRA said don’t blame us.

Regardless, many employees perceived a shift in office culture and are preparing to make a move.

“Even if people are happy where they live, they are looking,” Khemlani said. “Not everyone is ready to move but they are looking.”

Giving up space for a shorter commute

One of Khemlani’s clients works at Wells Fargo and has been renting in Rego Park with the goal of buying on Long Island or in New Jersey to get more space. But new RTO requirements have changed that plan. Now he has to be in the office four days a week, instead of two.

“He’s married and has a baby, and they wanted more space, but now that’s out of the question,” Khemlani said. His client is planning to stay in Queens and is looking at buying a three-bedroom condo or co-op in Rego Park or Forest Hills to be near the E and F subway lines and express bus service.

Unpredictable hours

Another one of Khemlani’s clients lives in Emerson, New Jersey, and works at Credit Suisse. His commute is over an hour, and now that he’s required to be in the office three or four days a week, he’s looking to buy in Hoboken or Jersey City to gain an easier commute.

Khemlani pointed out that Wall Streeters have unpredictable schedules, and so conforming to a commuter train schedule can be stressful, especially on nights when employees need to entertain clients.

He said his clients are making a tradeoff: putting off becoming owners for now and scaling down to be closer to work. “They’re ok with their money not going as far in order to have a shorter commute,” he said.

Priced out of NYC

Lisa James, an agent at the Corcoran Group, has a client who works for JPMorgan Chase who was fully remote during the pandemic. During the first quarter of this year, he was ordered back in the office four days a week.

The client owns a house with his family in Fort Lee, New Jersey. He considered keeping the home while buying something affordable in NYC. James showed him studio co-ops in the Bronx neighborhoods of Melrose and Kingsbridge, where the average price for that type of apartment is $115,000. He also looked at renting in Melrose, where the average rent is $2,956, she said.

Ultimately, however, with concerns about his salary, bonus, and perks, plus the cost of inflation and transportation, he decided to put the family home on the market and rent—in Fort Lee.

“His monthly costs didn’t make sense,” James said, adding he will be in a better position to make a move sometime in the future. “People are willing to sacrifice a few amenities in order to remain employed.”

Choosing where to make sacrifices appears to be the name of the game.

As Khemlani put it: “For employees in finance and tech, employers want you in and people want to be employed,” he said.

You Might Also Like